Audio Version: Let Me Hear It!

Certain pieces of advice need repeating before we’ll heed them, such as when your dentist tells you to floss or your doctor tells you to exercise more and – we know – when your financial advisor tells you to create a budget. So, this week, we’re pulling a favorite from our archive to remind you that budgeting doesn’t necessarily mean that you should spend less. It’s about knowing where your money is going and seeing if you’re really spending on the things that are most valuable to you.

Before diving into each credit card swipe and bill pay transaction, simply take stock of how much you’re saving. Tally up how much of your after-tax income you’re saving toward 401(k)’s or other employer plans, IRAs, investment accounts, bank savings and/or anywhere else you may be stashing money away. If you are setting aside at least 20% of your after-tax income, then your current spending habits are healthy.

Not saving 20%? Don’t panic. It’s just time to take a closer look at how you’re spending your money. Consider using an expense tracker to help capture everything. Or, look into a budgeting tool like Mint or Quicken to track and categorize your spending. Then, organize your expenses into two categories: needs and wants. Consider your “needs” to be expenses that cannot be avoided and are essential to your basic needs like mortgage or rent, food, gas and utilities. Everything else is a “want.” If you’re like most people, your allocation towards “wants” may surprise you and there are likely simple changes that will go a long way. If nothing else, knowing how you have been spending will make you more aware of mindless credit card swipes and your spending habits will start to change. We promise. If you are overspending on needs, it may be that your home is stretching you too thin or private school for the kids might be eating into your retirement nest egg.

Not saving 20%? Don’t panic. It’s just time to take a closer look at how you’re spending your money. Consider using an expense tracker to help capture everything. Or, look into a budgeting tool like Mint or Quicken to track and categorize your spending. Then, organize your expenses into two categories: needs and wants. Consider your “needs” to be expenses that cannot be avoided and are essential to your basic needs like mortgage or rent, food, gas and utilities. Everything else is a “want.” If you’re like most people, your allocation towards “wants” may surprise you and there are likely simple changes that will go a long way. If nothing else, knowing how you have been spending will make you more aware of mindless credit card swipes and your spending habits will start to change. We promise. If you are overspending on needs, it may be that your home is stretching you too thin or private school for the kids might be eating into your retirement nest egg.

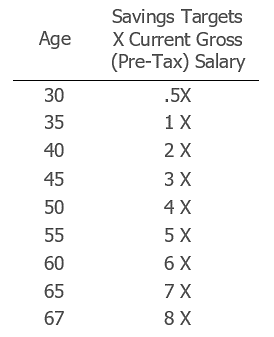

Saving 20%? Before enjoying that next splurge, check to see if your cumulative savings is on track. After all, your current spending will not reflect your previous habits, but your nest egg will. To see if you’re on track (to not have to work forever), refer to the minimum saving targets by age, below. If your cumulative savings is not on track, work with your financial advisor or use an online calculator to determine how much more you will need to save to catch-up.

Saving 20% and the nest egg is on track? Well done! Just be sure to avoid lifestyle creep. In other words, don’t let your lifestyle grow in proportion to your income. After all, the lifestyle you create today is the life you will have to fund in retirement. Rather than spending more with salary increases or bonuses, save them!