Your Dollars, Our Sense: A Fun & Simple Guide to Money Matters is a quick read that makes sense of a variety of topics including credit, saving priorities, investing, home ownership, insurance, marriage, children, retirement, estate planning and much more.

The goal is to provide readers with relatable and simple financial advice to help navigate various life stages and major life events in an entertaining, informative manner, escaping the dryness often associated with the topic.

As an International Best Seller having ranked #1 in six different business and finance categories, this book makes for a great shower, birthday and graduation gift, and a phenomenal read for any age.

Amazon Best Seller List Results:

#1 in Personal Finance

#1 in Business Life

#1 in Finance

#1 in Budgeting

#1 in Money Management

#1 in Mentoring & Coaching

#2 in Business & Money

To anyone who has thought, I should really know more about my finances, this book is for you. To anyone who has thought, There is just too much to know, this book is for you. Flip through or read cover to cover, it’s totally up to you!

What Readers Have to Say…

Important Disclosure: ‘Your Dollars, Our Sense’ was authored by the women of Beacon Pointe Advisors. The rankings on this site relate only to the book and should not be interpreted as a recommendation or endorsement of Beacon Pointe’s advisory services. Beacon Pointe Advisors did not pay to participate in any award or survey. Rating provided by Amazon Book Services in 2017. Best Seller Publishing was compensated by Beacon Pointe for facilitating the book publication and ranking process by Amazon Book Services. Barron’s and Financial Planning Magazine are not current clients of Beacon Pointe; additionally, the publications mentioned above are not being compensated for the endorsement of ‘Your Dollars, Our Sense.’

‘Dollars & Sense’ PRAISE & PRESS

From us to you:

Our passion, our dream… Educate, Empower, Engage. Take hold of your financial future. We’ll help you do so.

We get you because we are like you. We are moms, daughters, wives, sisters and friends. We’re also business owners, financial planners, investment advisors and lawyers. Like you, we are busy and we struggle to filter through the noise.

Sample The Sense

Chapter 5: Retirement

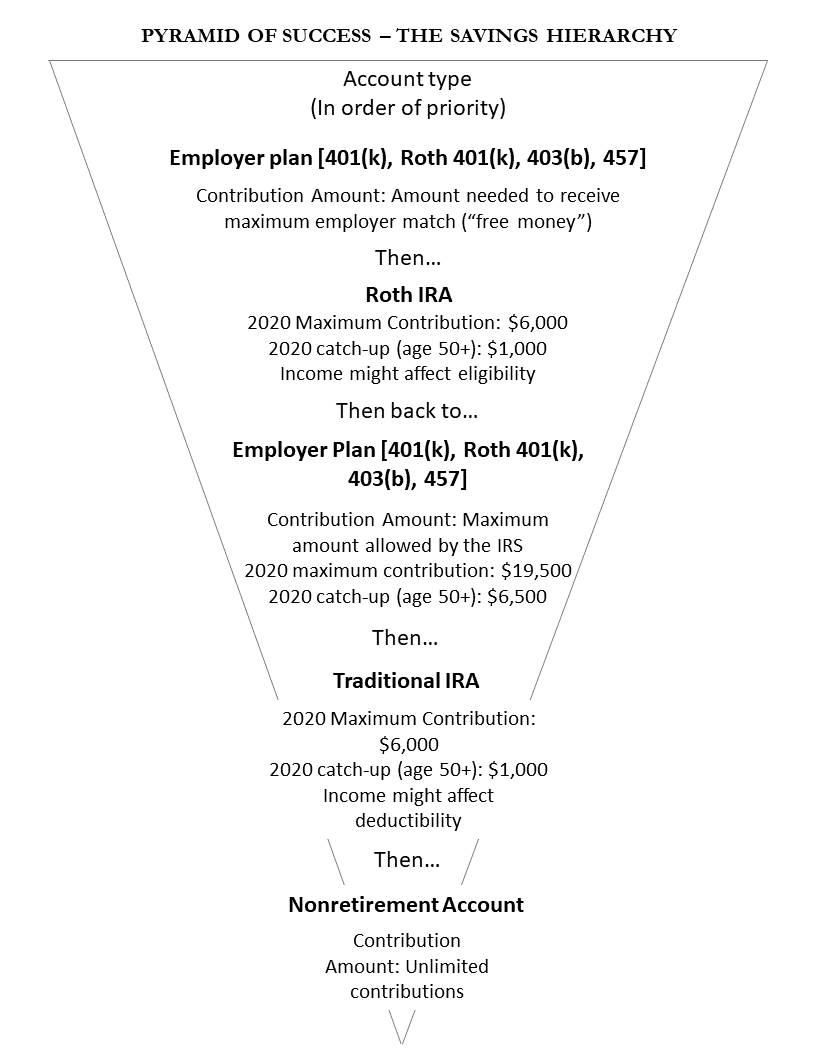

Pyramid of Success—Savings Hierarchy ………Page 58

You have some money to set aside, but what are you going to do with it? You’re not alone in not knowing how to put your money to work. It is so common an inquiry, in fact, that just searching “where should I put . . . ?” prompts an eerily clairvoyant online search to know that you probably want to ask where to put your money (immediately followed by where to put your subwoofer, but we can’t help you with that).

Most savers are probably looking for investment help, but what you should really determine first is, (1) if you are in a financial position to be investing, and (2) if so, the type of account in which you should invest.

The number-one priority for extra cash is paying off bad debts (for example, credit card debt), followed by establishing an adequate emergency fund, and then saving for retirement. Where to save for retirement might be confusing, given the number of factors to consider (account types, tax implications, employer contributions, etc.). If you are prepared to begin saving for retirement, the corresponding pyramid provides the generally accepted order for where to put your next saved dollar.