Audio Version: Let Me Hear It!

Last week, we gushed over the benefits of saving for retirement in an IRA but told you there were rules to the game, specifically certain eligibility considerations when contributing to IRAs. Understanding these eligibility rules is important so that you know all of your options when saving for retirement.

Traditional IRA

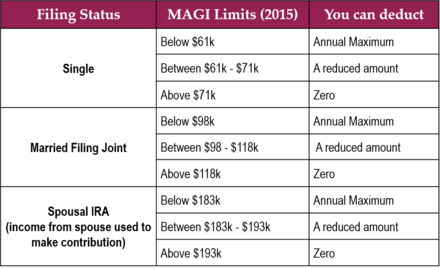

Deductibility – The tax deduction you receive for contributing to an IRA may be reduced based on two factors: retirement plans through work and your Modified Adjusted Gross Income (MAGI). If you or your spouse is an active participant in a workplace retirement plan and your MAGI exceeds a certain threshold, you can still fund a traditional IRA, but your deductibility will be affected (see below). It’s important to point out that being a high income earner won’t prevent you from taking the deduction if neither of you are active participants. Don’t let your decision to contribute hinge on deductibility alone, though, because the funds in the IRA will still grow tax-deferred, which is a powerful thing.

Roth IRA

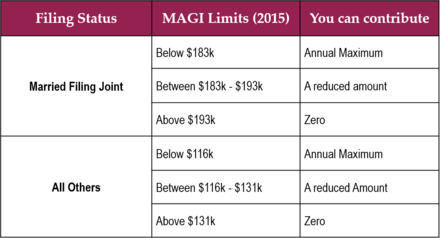

Contributions – Unlike a Traditional IRA to which you can always make contributions, Roth IRA contributions may be reduced or disallowed all together if your MAGI exceeds certain limits, as indicated below. MAGI is the only factor that determines Roth IRA contribution eligibility. If you contribute more than what is allowed in a year and fail to take corrective action, there will be a 6% penalty tax for every year the excess amount remains in the Roth.