Audio Version: Let Me Hear It!

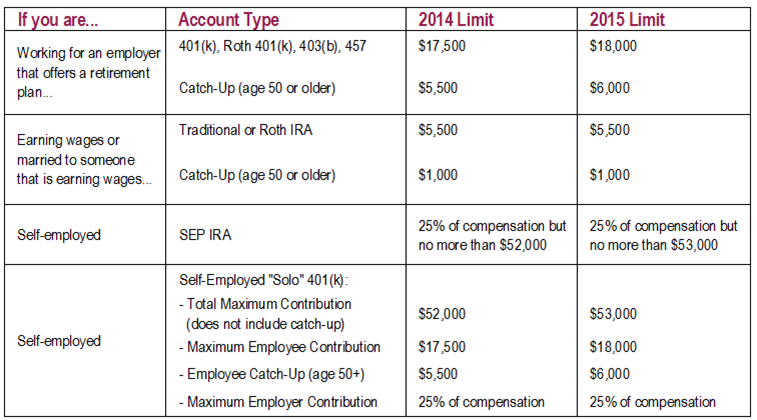

While you resolve to lose the extra holiday pounds, don’t forget to lose any outdated limits on what you can save in your retirement plans. Maximizing what you save using pre-tax dollars that grow tax-deferred or after-tax dollars that grow tax-free can make a huge difference on what you’ll have to live on in retirement. Throughout your working years, even an incremental $500 annual increase can provide over $50k in additional retirement savings! Check out our chart below to make sure you’re optimizing one of the most important (albeit few) perks the government gives you.

We must elaborate on a few key points:

If you are contributing to an employer plan such as a 401(k), Roth 401(k) 403(b), 457 Plans, you may be contributing a set dollar amount or percentage from each paycheck. If you are setting aside a fixed dollar amount – which we recommend if you plan to make the maximum contribution – you’ll need to increase the amount for each pay period.

If you want to save more or don’t have an employer plan, consider funding a Traditional or Roth IRA. The contribution limit for Traditional and Roth IRA’s is combined. This means that you may make a maximum contribution in 2015 of $5,500 (plus catch-up if over age 50) to either a Traditional, Roth or combination thereof. You may not contribute $5,500 (plus any catch-up amount) to both. If you’re not working, but your spouse has earned income, you can save too by piggy-backing off of your spouse’s income to make Spousal IRA contributions. Oh, and alimony received does count as earned income for purposes of making IRA contributions. According to the IRS, you’ve earned every penny of it! Finally, depending on your income, you may not receive a full tax deduction for your Traditional IRA contribution and may not be eligible to contribute to a Roth IRA. Say what?

If you’re self-employed, deciding which plan makes sense can be tricky, but don’t let that stop you from saving for retirement. For help, send us a message, consult your CPA or read more here.