Audio Version: Let Me Hear It!

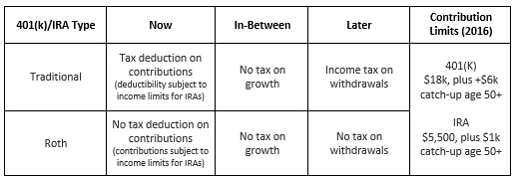

Although instant gratification has become a cultural norm, some things are just worth waiting for. Black Friday, encores, success, pumpkin spice lattes and, well, thanks to E.coli, fully baked cookie dough may come to mind. In the same way, delaying certain financial benefits can provide greater satisfaction in the long run. For those of you (and/or your spouse) that are offered a Traditional and Roth 401(k) option through work, or are considering an IRA contribution, the decision on which type to fund essentially comes down to whether you want an income tax benefit now or later. Specifically, does it make more sense to receive a tax deduction this year or tax-free income later? A quick summary of tax benefits and timing for each plan type follows.

How to Choose? If you are in your prime working years and your tax bracket is higher now than it will be when you expect to withdraw the funds in retirement, then it likely makes more sense to take advantage of the current-year tax deduction you would get by contributing to a Traditional 401(k) or IRA. If, on the other hand, you believe that your tax bracket is lower now than it will be when you plan to withdraw funds, then you might be better off funding a Roth 401(k) or IRA.

It’s also important to consider the value of an income tax deduction throughout your working years. Deductions become more valuable as your income goes up. If you are just starting out and believe your income is lower than what it will be in later years, then the deduction may be more valuable in the future. So, it may make sense to forgo the income tax deduction now with Roth contributions and switch to a Traditional 401(k) or IRA in peak earning years. If you’re somewhere in-between, a combination approach may be worth considering. You can contribute to both 401(k)’s in equal, or unequal amounts, provided your total contributions do not exceed the maximums shown above.