Audio Version: Let Me Hear It!

Let’s face it – the days of receiving a gold watch for 30 plus years of service to one company are so 1995. We’re living in a “move-on-to-move-up” culture and many of us have, or will, leave a trail of retirement plans in our wake. If leaving a plan behind was a conscious choice for you – awesome – but if you left your 401k, 403b or other employer retirement plan behind because you’ve been busy and didn’t know your options, this $ense is for you.

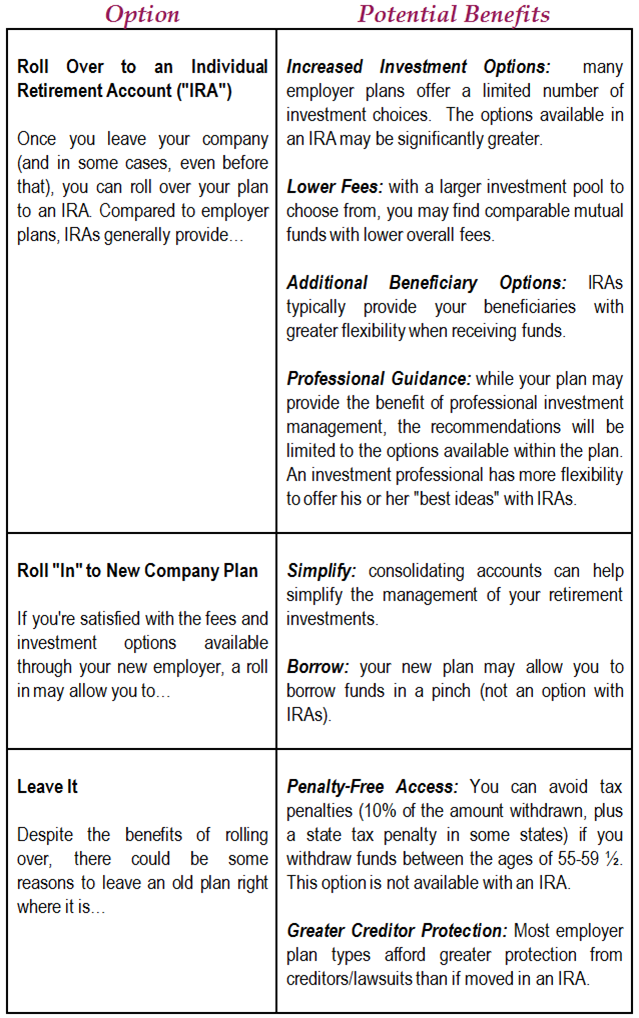

Below is a summary of your options and why you might choose each option:

Get Help With The Move: Deciding to move an old plan should not be done without the help of a professional. Be sure to work with your financial advisor or the IRA custodian (Schwab, Fidelity, TD Ameritrade, etc.). If not done correctly, you could lose significant tax benefits available on company stock held in your old employer’s plan or incur unintended tax consequences.