The man, the myth, the legend – John Wooden’s greatest accomplishments weren’t limited to basketball. He was the mastermind behind the fundamental skills that turn any dream into a reality, a.k.a. the “Pyramid of Success.” Following Wooden’s lead, we have our own version of the retirement Pyramid of Success. Most savers are probably looking for investment help, but what you should really determine first is, (1) if you are in a financial position to be investing, and (2) if so, the type of account in which you should invest.

The man, the myth, the legend – John Wooden’s greatest accomplishments weren’t limited to basketball. He was the mastermind behind the fundamental skills that turn any dream into a reality, a.k.a. the “Pyramid of Success.” Following Wooden’s lead, we have our own version of the retirement Pyramid of Success. Most savers are probably looking for investment help, but what you should really determine first is, (1) if you are in a financial position to be investing, and (2) if so, the type of account in which you should invest.

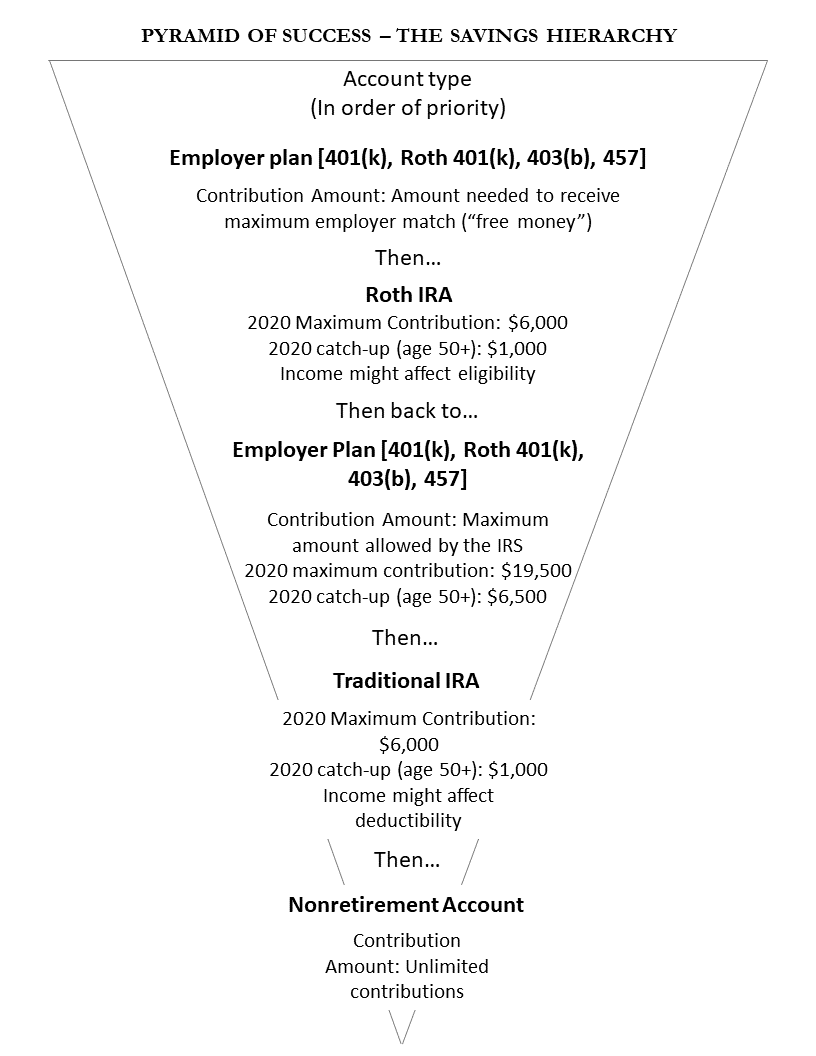

The number-one priority for extra cash is paying off bad debts (for example, credit card debt), followed by establishing an adequate emergency fund, and then saving for retirement. Where to save for retirement might be confusing, given the number of factors to consider (account types, tax implications, employer contributions, etc.). If you are prepared to begin saving for retirement, the corresponding pyramid provides the generally accepted order for where to put your next saved dollar.

PSSSSSST! Protip: Your company match is just that—a match. If your contributions from each paycheck reach the annual IRS limit before the end of the year, your employer might stop your paycheck contributions. And, you guessed it . . . no contributions by you could mean no match by your employer, and income earned for the balance of the year could go unmatched. If you expect to max out in a year, contribute a set dollar amount from each paycheck versus a percentage of your pay to ensure that you don’t max out early and miss out. Check with your Human Resources department to see if it offers a “true-up” contribution at the end of the year to fix this common oversight.