1. Select the correct definition for “bond.”

A. A loan of money to an entity (e.g. company or government) that is designed to appreciate over time as the entity proves its financial security.

B. A loan of money to an entity (e.g. company or government) that borrows the funds for a defined period of time, usually at a fixed interest rate.

For a refresher on how bonds work, check out The Price for Something Better.

2. True or False: An active fund/investment product is one that tries to beat a benchmark and a passive fund/investment product is one that tries to mimic a benchmark.

A. True

B. False

For the low down on active versus passive investing, enjoy The More Things Change.

3. Suppose you had $100 in a savings account and the interest rate was 2% per year. At the end of each year, the interest earned is deposited into the savings account. After 5 years, how much do you think you would have in the account if you left the money to grow?

A. More than $110

B. Exactly $110

C. Less than $110

Remember, compound interest generates earnings on your initial investment and on earnings the investment has previously made. In year one, 2% is paid on $100, for a balance of $102. In year two, 2% is paid on $102, and so on. For compounding put simply, read It’s Grow Time.

4. Select the correct definition for “mutual fund.”

A. A fund comprised of a variety of assets intended to provide financial security to an individual, typically once the individual reaches a certain age.

B. A pool of funds collected from many investors for the purpose of investing in stocks, bonds, money market instruments and similar assets. Each investor retains ownership of his or her portion of the overall investment.

For more on mutual funds, check out Same, But Different.

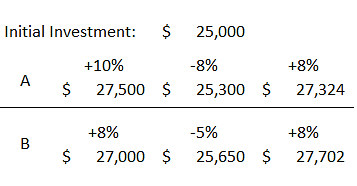

BONUS: Which investment would you rather own?

A. Earns 10% in the first year, loses 8% the second year and earns 8% the following year.

B. Earns 8% in the first year, loses 5% in the second year and earns 8% the following year.

Although investment A earns more in the 1st year and the same amount as investment B in the 3rd year, the losses in year two keep investment A behind investment B (see math below). To recoup a loss of 8%, investment A must return 8.7%, compared to investment B that requires just 5.2% to break-even after year two. Want more? Check out how Market Volatility is Your Friend….