Jameson Van Houten, Partner and Managing Director of Beacon Pointe’s Scottsdale, AZ office, shares essential financial advice when comparing good and bad debt.

John Wooden’s greatest accomplishments weren’t limited to just basketball. He was the mastermind behind the fundamental skills that turn any dream into a reality, a.k.a. the “Pyramid of Success.” Following Wooden’s lead, we have our own version of the retirement Pyramid of Success. Most savers are probably looking for investment help, but what you should really determine first is, (1) if you are in a financial position to be investing, and (2) if so, the type of account in which you should invest.

The number-one priority for extra cash is paying off bad debts (for example, credit card debt), followed by establishing an adequate emergency fund, and then saving for retirement within your budget. After these items are addressed, then it is time to redirect your attention to (2).

So how can one determine the difference between good debt and bad debt?

Good debt should be considered as worthwhile purchases that will increase a person’s quality of life, especially an education since it’s something that will most likely lead to an increase in income over time.

Feeling bad over large debts like this is a waste of time since they happen quite frequently in life and are something worth investing in. But when debt isn’t purposeful, at times it can become a large problem. One of the worst ways to accumulate debt is the use of high-interest rate credit cards for everyday purchases. Being honest with oneself about what is attainable and manageable within a person’s finances will hopefully avoid many years of paying a minimum payment that only chips away at the balance. Therefore, understanding the difference between the two debts is vital to your present and future expenses.

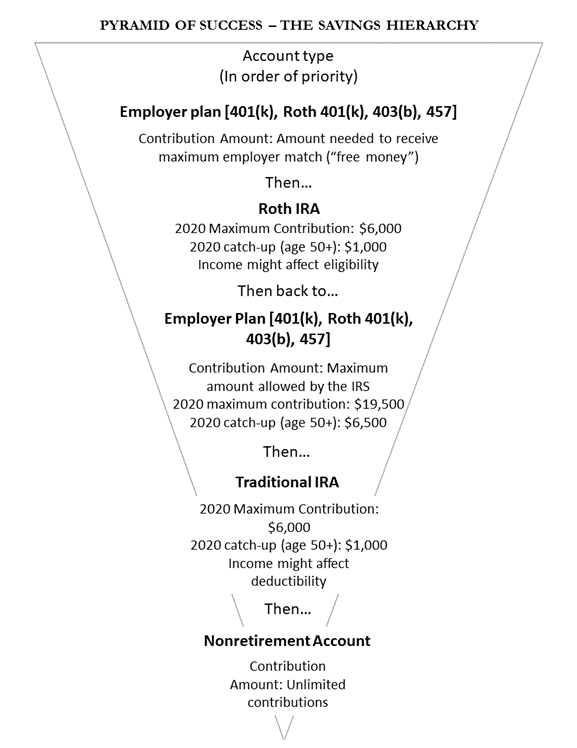

After expenses are determined and there is extra cash left over, our focus can now be redirected to investing. Where to save for retirement might be confusing, given the number of factors to consider (account types, tax implications, employer contributions, etc.). If you are prepared to begin saving for retirement, the corresponding pyramid below provides the generally accepted order for where to put your next saved dollar.

About Jameson Van Houten:

Jameson Van Houten and his team recently joined Beacon Pointe Advisors in a 2021 acquisition, further expanding the Beacon Pointe presence in the Grand Canyon state and bringing another $430M to its growing AUM. As the founder and sole owner of Stonegate Capital Advisors, Jameson was brought on as a Beacon Pointe Partner and Managing Director – one of six in the Scottsdale area.

Jameson Van Houten has nearly twenty years of experience in the financial services industry. He founded Stonegate Capital Advisors in 2002 and built an impressive wealth advisory business based on deep roots and organic growth. Jameson leads an experienced and knowledgeable team serving a niche clientele base, not only in Arizona but also across numerous other states. The team’s specialties and services as Stonegate Capital Advisors included business, estate, and tax planning, as well as asset protection planning. Jameson and his team looked to merge with a larger firm like Beacon Pointe to expand upon the services they could offer their clients while also providing additional growth opportunities for employees.

Important Disclosure: The information contained in or linked to this post is for informational purposes only. It is neither intended nor should it be construed as investment, financial, tax, or legal advice. Beacon Pointe provides links for your convenience to other providers’ websites. Beacon Pointe is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve or endorse the information provided.