What’s Up Docs?

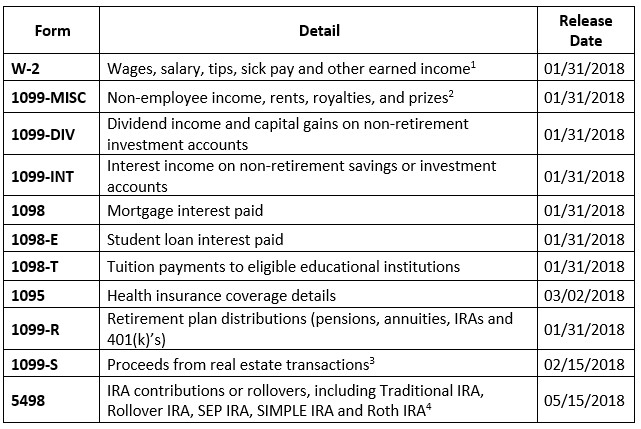

By now, various tax-related documents have started to trickle in. Printed boxes are filled with numbers or letters or check marks, none of which make a lot of sense to the untrained eye. If you’re just a little curious to know what these forms are telling the IRS about you or which forms you should expect this filing season, breeze through our summary of the most common tax forms below.

Just like everything else in your home, these tax forms should have a place. If you haven’t already, set them aside in an envelope marked “2017 TAXES,” a file cabinet, or other dedicated space to help keep this filing season organized. Better yet, take us up on last week’s offer to get a personal finance dashboard and aggregate your entire financial life – including important documents – all in one place.

Footnotes:

- Wages, tips and other compensation reported in box 1 on Form W-2 excludes amounts contributed to qualified retirement plans, such as a 401(k) or 403(b), as these contributions are tax-free. Social Security wages may also be capped at maximum wage base of $127,200 for 2017. If you’re curious to know your total income earned, including amounts contributed to a retirement plan, refer to Medicare wages and tips as Medicare tax is paid on all earned income.

- If you are self-employed (or receive Form 1099-MISC), prepare to file by itemizing business expenses, including items such as license fees, business or E&O insurance, office rent, phone, miles driven, advertising, etc. If you work out of your home, to get credit for your home office expenses, you must have an area of your home that is used exclusively for business purposes. Being prepared will save time and may help reduce taxes.

- Form 1099-S will be provided by the escrow company you used to sell the property. NOTE: You will receive Form 1099-S even if the proceeds aren’t taxable (e.g., the gain is excludable due to primary residence exclusion or basis was less than or equal to the sales price).

- IRA contributions for 2017 can be made until April 17th, 2018. Accordingly, to ensure that all allowable activity is reported, Form 5498 is often not released until after this tax-filing due date. Not to worry; transactions are reported by your custodian to the IRS, even if the form has not yet been provided to you. Discuss your contributions, rollovers or conversions with your tax advisor and provide the form once available. He or she will file accordingly.