Audio Version: Let Me Hear It!

It’s likely that New Year’s resolution-goers are still cramping your style at the gym. All of the equipment is full and there’s barely room for your walking lunges. Just as there are seasons when a herd at the gym will make it hard to get in a good stretch, there are times in life when a crowd of financial responsibilities can make it hard to stretch your savings. Not to worry, there will be lulls in gym-going activity after the holidays and before beach bod summers, and there will be times in your life when you will have more discretionary income to save.

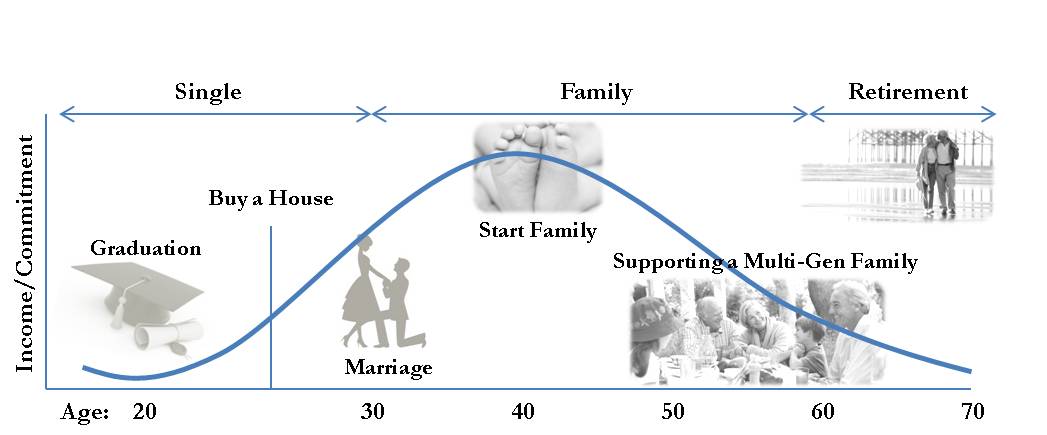

Discretionary income is the amount of income that is left, after taxes and after paying for the basic necessities in life; it is the pool from which you save. Even though your income will likely be lower in your 20’s and early 30’s, less of it will be allocated towards necessary expenses at this point in your life, leaving more room for saving. Be sure to maximize your opportunity to save during this time. In your mid 30s and 40s, you will have very little discretionary income as life happens. Kids, mortgage, new car, increased groceries, additional insurance needs – you get the picture. This is the time when saving seems impossible. Don’t beat yourself up. The time for saving will come again. In your 50s and 60s, kids are grown, college is a memory, the mortgage is close to being paid off and retirement is in sight. It may feel like you have been given a raise and your saving muscle will strengthen again.

They key is to actually put savings aside when discretionary income is at its highest. Overcompensating during these years can help reduce stress in times where spending peaks.